Two debt brokers (businesses which buy junk debt, then sell it to other junk debt buyers) were sued by the FTC earlier this year for posting on the internet private personal financial information about individual consumers for public view, as part of their attempts to market portfolios of junk debt to JDBs.

Cornerstone and Company, LLC (from California) (complaint here) and Bayview Solutions, LLC (from Florida) (complaint here) posted Excel spreadsheets that displayed private consumer financial information on a website open to the public. Anyone visiting the website was able to access these spreadsheets. According to the FTC, the sheets were downloaded more than 500 times and more than 70,000 consumers may be affected.

The FTC sums up the harm behavior like this can cause:

[T]he disclosures violated the consumers’ privacy, put them at risk of identity theft, and exposed them to “phantom” debt collection, a practice in which unscrupulous debt collectors try to extract payments from consumers when they do not have authority to collect the debts. The FTC noted that the disclosures also publicly branded the consumers as debtors, putting them at risk of other harms, including possible loss of employment or employment opportunities. [emphasis added]

The risk of phantom debt collection will cast a long shadow over any debt which may have been exposed online. How can anyone be sure that a person holding themselves out as the owner of these debts really is the owner? (This is a point which has been driven home repeatedly by Jake Halpern in talks about his book, Bad Paper, here.). This case further emphasizes the need for judges, regulators, consumers and litigants to demand that debt buyers provide sufficient documentation of their ownership when they try to collect debts, especially through the courts.

Cornerstone and Bayview are both now subject to temporary orders prohibiting them from engaging in this behavior and requiring them to contact consumers who’s information they posted. Bayview consented to the order. Cornerstone did not consent, but the court granted a substantially similar order.

The New York Times reports that neither Bayview nor Cornerstone could be reached for comment.

The behavior of Bayview, at least, seems inconsistent with the stated views of the company. Bayview produced a series of videos about debt buying, including one on managing data in excel. The author states

You have to protect your data and you have to have high security because you’re dealing with people’s personal and sensitive information

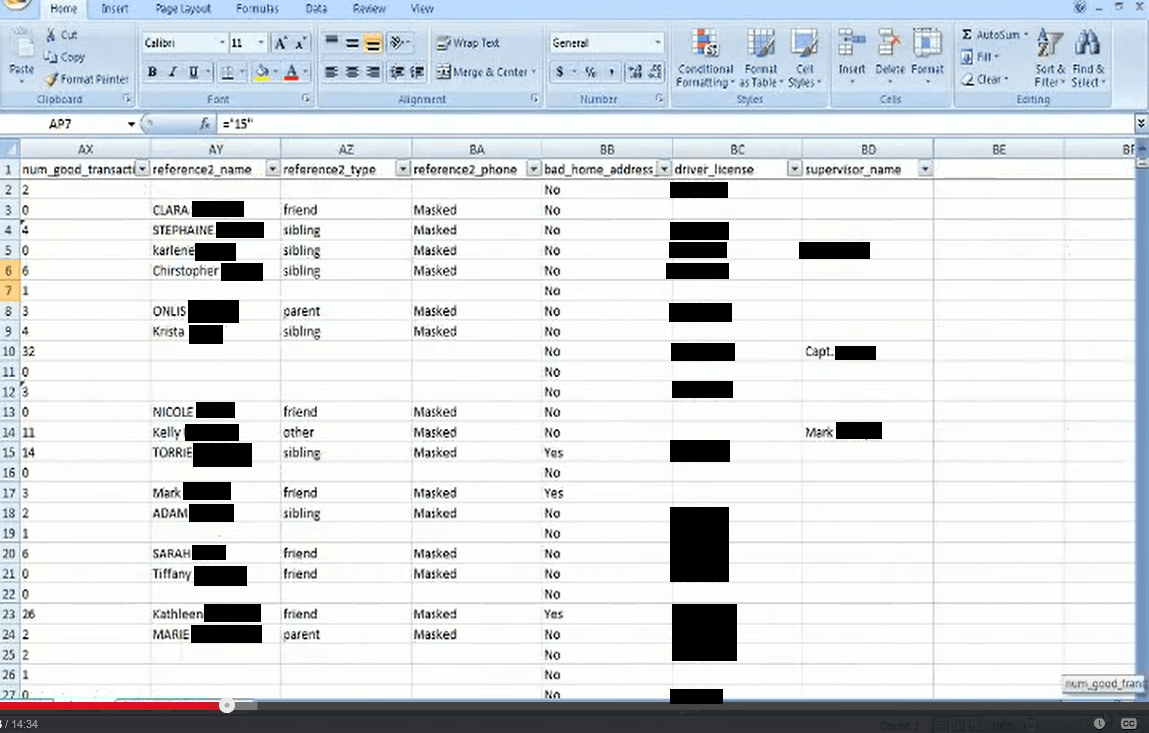

Despite this the author does not baulk at showing unredacted email addresses, first names, zipcodes, and employers. Even worse, the video shows the unredacted names of “references” and their relation to the named consumers, driver’s license numbers and even the names of some of the consumers’ work supervisors.

The video was still online as of 11/13/2014.